4 min read • 3 days ago

For years, retirement planning focused almost entirely on market returns. But as we head into 2026, financial professionals are increasingly pointing out a deeper truth:

The biggest risks to retirement aren’t just market-related — they’re behavioral, structural, and long-term.

Recent discussions among retirement experts highlight that poor decisions, inflation, longevity, and rising healthcare costs often do more damage than temporary market downturns.

Understanding these risks — and planning for them — is what separates retirement confidence from retirement stress.

Behavioral risk is widely considered the most dangerous retirement risk — because it magnifies every other one.

Common examples include:

These reactions often lock in losses and prevent recovery.

People are living longer — often much longer than expected.

A retirement that lasts 30+ years isn’t unusual anymore. Without planning for longevity, even a well-funded portfolio can be depleted too soon.

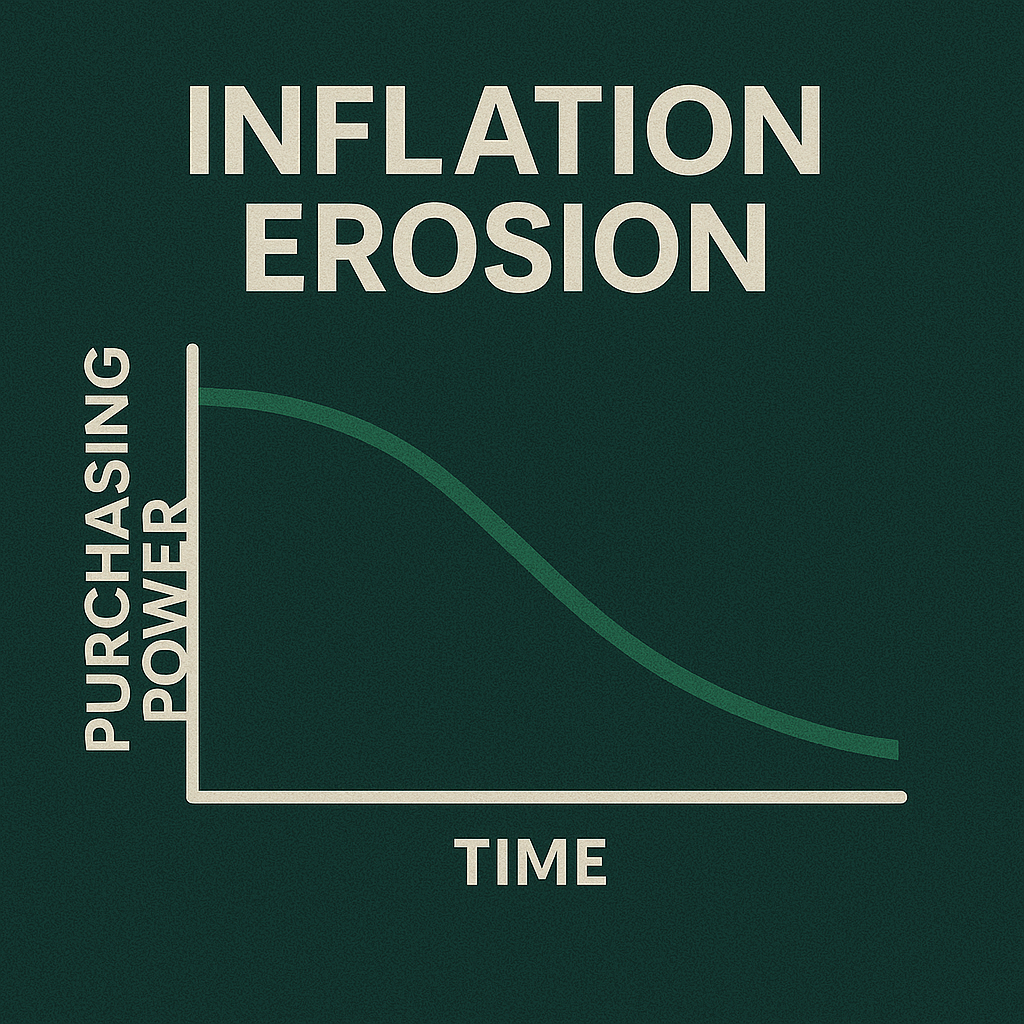

Inflation doesn’t feel dramatic year to year — but over decades, it quietly erodes spending power.

At just 3% inflation:

Healthcare is one of the most unpredictable retirement expenses.

Medicare doesn’t cover everything — and long-term care costs can significantly impact savings late in life.

Market volatility itself isn’t the main problem — when volatility occurs matters more.

Poor returns early in retirement, combined with withdrawals, can permanently reduce portfolio longevity.

This is known as sequence-of-returns risk.

Retirement rules change.

Contribution limits, RMD ages, and tax treatment evolve over time — and planning must remain flexible.

SECURE 2.0, updated contribution limits, and future tax uncertainty all make adaptability essential.

Knowing the risks is only half the equation. The real advantage comes from planning for them proactively.

Modern retirement planning focuses on:

Nestly is designed to help you see retirement risk — not guess at it.

With Nestly, you can:

Instead of reacting emotionally, you can plan with clarity.

✅ Retirement risk is broader than market volatility

✅ Behavioral decisions often cause the most damage

✅ Longevity and inflation quietly compound risk

✅ Healthcare costs require deliberate planning

✅ Flexible, probability-based planning improves outcomes

Retirement success isn’t about avoiding every risk — it’s about understanding them and planning accordingly.

In 2026 and beyond, the investors who succeed won’t be the ones chasing returns — they’ll be the ones who stay disciplined, adaptable, and informed.

Planning ahead makes all the difference.

Discover proven strategies to boost your retirement savings in 2026, including higher IRS contribution limits, employer match optimization, and smart planning with Nestly.

Artificial intelligence is transforming jobs, investing, and financial planning. Learn how AI growth will impact retirement savings, risk management, and how to prepare.

The IRS has officially released 401(k) and IRA contribution limits for 2026. Learn the new limits, catch-up rules, and how Nestly’s Contribution Co-Pilot helps you optimize savings.